Approved by the House of Representatives on 30 October 2024, Complementary Bill (CB) 108/2024 is a cornerstone of Brazil’s Tax Reformof Brazil’s Tax Reform. It establishes and regulates the Management Committee for the Goods and Services Tax (IBS), a unified consumption tax that consolidates levies such as ICMS (Tax on the Circulation of Goods and Services) and ISS (Service Tax). The bill also creates a Higher Council to coordinate and oversee the new tax and regulate its administrative adjudication.

The bill introduces changes to rules governing ITCMD (Tax on Inheritance and Donations) and ITBI (Tax on the Transfer of Real Estate) taxes. To minimize economic impacts on businesses, it establishes a transition period for implementation. The proposal provides differentiated treatment for specific sectors, including agriculture, industry, and services, while simplifying tax legislation by reducing excessive regulations.

CB 108/2024 now moves to the Senate, with approval expected in 2025. The transition requires businesses, tax administrations, and consumers to adjust to a new model of tax collection, oversight, and redistribution. Continuous monitoring will be essential to ensure effective implementation.

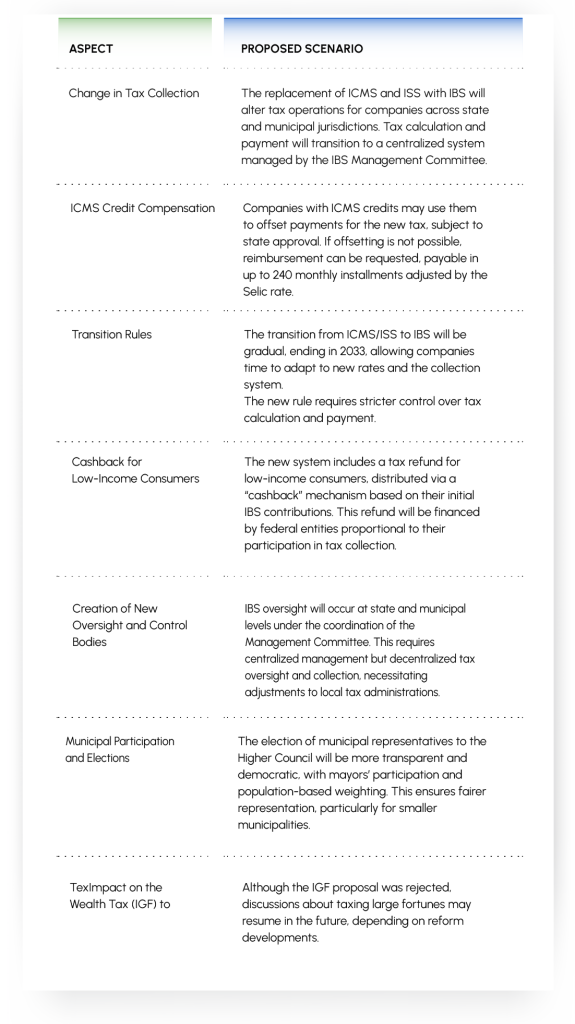

Below are the key practical aspects and changes for companies and taxpayers:

Glossary:

Complementary Bill (CB) 108/2024 – a legislative proposal forming a key part of Brazil’s Tax Reform, introducing the Goods and Services Tax (IBS) and changing tax regulations, including the ITCMD and ITBI.

Tax Reform – a structural overhaul of Brazil’s tax system aimed at simplifying processes, unifying taxes, and reducing bureaucracy.

Goods and Services Tax (IBS) – a unified consumption tax that consolidates multiple taxes, including ICMS and ISS, into a single levy.

ICMS (Tax on the Circulation of Goods and Services) – a state tax on goods and some services, applied throughout Brazil.

ISS (Service Tax) – a municipal tax on services, levied by cities and towns in Brazil.

ITCMD (Tax on Inheritance and Donations) – a state tax on inheritances and donations in Brazil.

ITBI (Tax on the Transfer of Real Estate) – a municipal tax on real estate transactions.

IBS Management Committee – a centralized body established to oversee and manage the calculation, collection, and distribution of the IBS.

Selic Rate – Brazil’s benchmark interest rate, used to adjust monetary values such as tax reimbursements or penalties.

Controlled Foreign Corporation (CFC) Rules – Brazilian regulations governing the taxation of profits earned by foreign subsidiaries of Brazilian companies.